Guide: Remote Monitoring for Banks and Financial Services

This article delves into the importance of secure remote access in the banking sector, highlighting its benefits and potential challenges. It discusses best practices to implement secure remote access and recommends AnyViewer as the top choice for banks seeking reliable and secure remote access solutions.

Introduction

In today’s fast-paced financial landscape, banks and financial institutions face a plethora of challenges that require innovative solutions. Among these, remote monitoring for banks and financial services stands out as a game-changer. As technology continues to evolve, institutions are increasingly leveraging remote monitoring to enhance security, improve customer service, and streamline their operations. What does this involve, and why is it so important? Let’s delve deeper into the world of best remote monitoring for banks and financial services and uncover its significance for financial services.

Understanding Remote Monitoring

What is Remote Monitoring?

Remote monitoring refers to the process of continuously observing and managing various systems, networks, and devices from a distance using specialized software. It allows institutions to keep track of operations, ensure compliance, and detect potential issues before they escalate. In essence, remote monitoring serves as the financial watchdog, alerting institutions to anomalies and ensuring everything runs smoothly.

Importance of Remote Monitoring for Banks and Financial Services

In the financial sector, where security and compliance are paramount, remote monitoring serves as a vital tool for managing risks and enhancing operational efficiency.

Enhancing Security Measures

Banks are prime targets for cybercriminals, making security a top priority. Remote monitoring helps banks detect and respond to threats in real time. With constant surveillance of network activities, banks can identify potential breaches before they escalate, protecting sensitive customer information and maintaining trust.

Ensuring Regulatory Compliance

The financial industry is heavily regulated, with strict guidelines to follow. Remote monitoring systems enable banks to maintain compliance by tracking transactions and ensuring that all operations adhere to regulatory standards. This level of oversight helps mitigate the risk of costly fines and reputational damage.

How Remote Monitoring Works

Remote monitoring works by leveraging a combination of software and hardware tools. Banks install monitoring software on their systems, which collects data and sends it to a central dashboard. This setup enables financial institutions to track their operations, analyze performance metrics, and respond swiftly to any issues that arise.

Key Features of Remote Monitoring

Remote monitoring systems come equipped with several key features, including:

- Real-time Monitoring: Continuous observation of network activities and system performance.

- Alerts and Notifications: Automated alerts for unusual activities or potential threats.

- Data Analysis: Comprehensive reporting tools that provide insights into system health and usage patterns.

- User-friendly Dashboards: Easy-to-navigate interfaces that present information clearly.

Benefits of Remote Monitoring for Banks

Implementing remote monitoring for banks and financial services jobs offers several key benefits:

Enhanced Security

Let’s face it: financial institutions are prime targets for cyberattacks. Remote monitoring helps banks bolster their security posture. By continuously tracking network activity, banks can detect suspicious behavior and respond swiftly to potential threats. This proactive approach not only protects sensitive data but also reinforces customer trust. After all, when customers feel secure, they're more likely to engage with your services.

Real-time Data Access

Imagine a scenario where a bank can access transaction data and system health in real time. This capability is made possible through remote monitoring. By providing instant access to crucial information, banks can make informed decisions quickly, whether it’s flagging a potentially fraudulent transaction or optimizing operational efficiency. It’s all about staying ahead of the curve and being proactive rather than reactive.

Customer Experience Improvement

In the highly competitive world of banking, customer experience can make or break an institution. Remote monitoring allows banks to analyze customer interactions and service usage patterns. By understanding these trends, banks can tailor their offerings, enhance customer support, and deliver personalized experiences. Ultimately, this leads to greater customer satisfaction and loyalty.

Streamlined Operations

Remote monitoring simplifies operations by automating many processes. By utilizing advanced monitoring tools, banks can streamline workflows, reduce manual oversight, and allocate resources more effectively. This increased efficiency not only saves time but also reduces operational costs in the long run.

Challenges of Remote Monitoring

Data Privacy Concerns

While remote monitoring offers numerous advantages, it also raises concerns about data privacy. Banks must ensure that customer data is safeguarded against unauthorized access and breaches. Compliance with data protection regulations, such as GDPR, becomes crucial in maintaining trust and integrity.

Implementation Costs

Let’s not sugarcoat it: setting up a robust remote monitoring system can be costly. Banks need to invest in technology, training, and ongoing maintenance. However, the long-term advantages usually surpass the initial costs. By reducing the risk of breaches and improving operational efficiency, remote monitoring can lead to significant savings over time.

Compliance and Regulatory Issues

The financial sector is heavily regulated, and banks must navigate a complex web of laws and guidelines. Implementing remote monitoring solutions that comply with these regulations can be challenging. Failure to do so may result in hefty fines and damage to reputation.

The Role of Technology in Remote Monitoring

Tools and Software for Remote Monitoring

Technology plays a pivotal role in enabling effective remote monitoring. Various tools and software solutions have emerged to assist banks in this endeavor. These solutions provide features such as:

- Real-time alerts: Notify administrators of suspicious activities.

- Dashboard views: Offer a consolidated overview of operations.

- Data analytics: Analyze trends and patterns for better decision-making.

How Technology Enhances Security

In a world where cyber threats are rampant, technology enhances security measures significantly. Advanced software solutions can use machine learning algorithms to detect anomalies, flagging them for immediate review. This proactive approach helps banks stay one step ahead of potential breaches.

Best Practices for Effective Remote Monitoring

Strategies for Implementation

To maximize the benefits of remote monitoring, banks should consider the following best practices:

- Invest in Robust Software Solutions: Choose comprehensive tools like AnyViewer that provide security, efficiency, and scalability.

- Train Employees: Ensure that staff are well-trained in using monitoring tools and understanding data security protocols.

- Regularly Review and Update Systems: Technology evolves rapidly, so it’s essential to stay updated on the latest security features and compliance regulations.

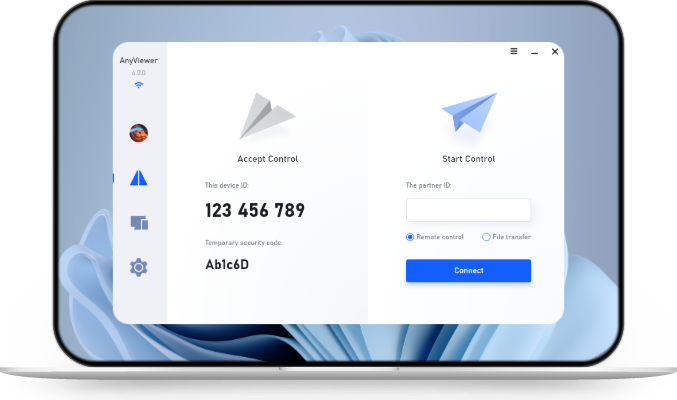

AnyViewer: Best Free Remote Monitoring Choice

AnyViewer stands out as the best free remote monitoring software for banks and financial services, offering a comprehensive suite of features tailored to the unique demands of the financial sector. With its robust security protocols, including end-to-end encryption and multi-factor authentication, AnyViewer ensures that sensitive financial data remains protected from unauthorized access. Its intuitive user interface enables financial institution staff to effortlessly remotely control work computers to monitor systems and manage remote access, streamlining operations while ensuring compliance with strict industry regulations.

In addition to security, AnyViewer offers seamless cross-platform compatibility, enabling users to connect from various devices and operating systems without a hitch. This flexibility empowers financial organizations to maintain continuous oversight of their systems, quickly address potential issues, and enhance their operational efficiency. Furthermore, with its built-in file transfer and screen sharing capabilities, teams can share important documents securely in real time, fostering collaboration without compromising security.

AnyViewer's screen wall feature is particularly impressive, allowing users to monitor multiple screens from one centralized display. This functionality facilitates the simultaneous oversight of several devices, offering customizable layouts and smooth integration across different devices, which improves management efficiency. By choosing AnyViewer, financial organizations can not only enhance their operational efficiency but also cultivate a proactive security posture, making it an indispensable tool in today's digital banking landscape.

Step 1. Open AnyViewer on your local device and the device you are using remotely. Make sure to create an account and log in on each device.

Step 2. On your local device, go to the "Device" section, locate your remote device, and enable unattended access by clicking "One-click control."

Step 3. Once the setup is complete, you'll have complete control over the remote device’s mouse and keyboard, enabling you to manage it as if you were physically there.

- ★Tips: Upgrading to a Professional or Enterprise plan provides several significant benefits, including:

- Extended Unattended Remote Access: Gain support for more device assignments and access a detailed list of connected devices to monitor connection history.

- Enhanced Privacy: Utilize Privacy Mode to hide the screen and disable remote input on the controlled computer, ensuring greater security.

- Faster Data Transfers: Improve the speed of data exchanges between devices.

- Simplified Device Management: Organize devices into groups for more efficient control, especially in large-scale setups.

- Multi-Device Monitoring: Use screen walls to monitor multiple devices simultaneously, enhancing oversight.

- Increased Efficiency: Take advantage of mass deployment features for quick setup across multiple devices at once.

- ...

To access and monitor multiple devices simultaneously using AnyViewer's screen wall feature, follow these steps:

Step 1. Go to the "Device" section and select your local device, then choose "Screen wall."

Step 2. To start the setup wizard, click the "Create screen wall" button.

Step 3. Select the devices you want to monitor at the same time and click "Add."

Step 4. The chosen devices will now be displayed in a single window, enabling efficient monitoring from one view. To control any of these devices, simply click on the desired screen to take remote control.

Conclusion

In summary, remote monitoring for banks and financial services is not just a trend; it’s a necessity for enhancing security, compliance, and customer satisfaction in today’s fast-paced financial landscape. By leveraging tools like AnyViewer, financial institutions can effectively oversee their operations, respond to potential threats in real time, and maintain regulatory compliance. This proactive approach not only streamlines operations but also fosters trust among customers, ensuring a secure and efficient banking experience. As technology continues to evolve, embracing remote monitoring will be crucial for banks aiming to stay competitive and secure.