Remote Access for Finance and Banking: Secure, Efficient Solutions with AnyViewer

This article delves into the crucial role of remote access in the finance and banking sectors, exploring its significance, key features to consider when choosing remote access software, and why AnyViewer is the top choice for professionals in these industries.

Introduction

In today's fast-evolving financial landscape, the need for flexibility and security is more important than ever. With remote work on the rise and more financial institutions going digital, having the right remote access solutions has become critical for finance and banking. But what exactly is remote access, and why should the finance industry care? Let’s dive into the world of remote access for finance and banking services, uncover the essential features you should prioritize, and see why AnyViewer stands out as the best solution for the remote access for finance and banking jobs.

The Evolution of Banking Technology

Gone are the days when banking meant standing in long lines and filling out paper forms. The financial sector has undergone a massive transformation over the last couple of decades, primarily due to technological advancements. The advent of the internet, mobile applications, and cloud computing has revolutionized how banks operate and serve their clients. Now, with just a few clicks, customers can check their balances, transfer funds, and even apply for loans.

With this evolution, however, comes a growing demand for robust remote access solutions. Banks are now required to provide their customers and employees with seamless access to financial information without compromising security. This shift has opened doors to innovative remote access solutions tailored specifically for the finance sector.

What is Remote Access?

So, what exactly is remote access? In simple terms, remote access allows users to connect to a computer or network from a distance. This connection enables users to access files, applications, and even sensitive data as if they were sitting right in front of their desktops. In finance, this means that bankers, accountants, and financial analysts can work from anywhere—be it a coffee shop, a home office, or while traveling.

Remote access is facilitated through various technologies, including virtual private networks (VPNs), remote desktop applications, and cloud-based services. Each of these methods allows for different levels of access and control, catering to the diverse needs of the finance industry.

The Importance of Remote Access in Banking

So, why is remote access for finance and banking jobs such a big deal? Let’s break it down.

Enhancing Security

Security is paramount in the financial sector. Remote access solutions come equipped with robust security measures, including encryption, multi-factor authentication, and secure connections. These features ensure that sensitive data remains protected, even when accessed from a remote location. With the increasing threats of cyber-attacks, having secure remote access is not just beneficial; it’s essential.

Increasing Efficiency

Imagine being able to approve a loan application, access critical financial reports, or communicate with clients without the constraints of your office. Remote access allows for this level of flexibility. It can lead to quicker decision-making processes, improved customer service, and increased overall productivity. By empowering employees to work from anywhere, banks can adapt to the dynamic demands of the market.

Case Study: Successful Implementation

Consider the example of a prominent banking institution that implemented remote access solutions across its branches. By allowing loan officers to work from home or on the go, the bank saw a 30% increase in productivity. Employees could respond to client queries in real time, leading to faster loan approvals and higher customer satisfaction. This success story illustrates just how transformative remote access can be in finance.

Benefits of Remote Access for Finance and Banking

The benefits of remote access in finance and banking are abundant. The following are some noteworthy benefits:

- Increased Productivity: With remote access, employees can work from anywhere, leading to more flexible schedules. This flexibility often translates to increased job satisfaction and productivity.

- 24/7 Availability: Financial markets don’t sleep, and neither should your access to them. Remote access allows users to manage their finances at any time, making it easier to respond to urgent matters.

- Cost Savings: Remote access reduces the need for physical office space and resources, ultimately saving money for financial institutions.

- Enhanced Collaboration: Teams can easily collaborate on projects regardless of their physical locations. This capability fosters a more dynamic and responsive work environment.

- Improved Customer Service: Customers expect instant service. Remote access enables bank employees to assist clients promptly, even when they’re not in the office.

While these benefits are enticing, they come with their own set of challenges—primarily around security.

Challenges of Remote Access in Finance

While remote access offers numerous benefits, it’s not without challenges. Common obstacles include:

- Compliance Issues: Financial institutions must navigate strict regulatory requirements concerning data access and security.

- Technical Difficulties: Not all remote access solutions are user-friendly. Complicated setups can hinder productivity.

- Data Privacy Concerns: Accessing sensitive information remotely can increase the risk of data breaches if not managed correctly.

With great power comes great responsibility, right? As financial institutions embrace remote access, they also face increasing security concerns. Cybersecurity threats such as data breaches, phishing attacks, and ransomware are all too common in today’s digital landscape. For banks, the stakes are particularly high, as a security breach can result in financial loss and a tarnished reputation.

Banks need to implement stringent security measures to protect sensitive customer data and ensure compliance with regulatory standards. This includes encryption, multi-factor authentication, and continuous monitoring of access logs. Without these safeguards, the benefits of remote access could quickly turn into liabilities. Understanding these challenges is crucial for organizations looking to implement remote access effectively.

Best Practices for Safe Remote Access

To mitigate the risks associated with remote access, financial institutions should adopt best practices, such as:

- Regular Security Audits: Conduct frequent audits to identify vulnerabilities in remote access systems.

- Employee Training: Ensure all employees are well-trained on security protocols and the importance of safeguarding sensitive information.

- Use of Strong Passwords: Encourage the use of strong, unique passwords and the implementation of multi-factor authentication to enhance security.

- Monitor Access: Keep a close eye on who has access to sensitive systems and data. Regularly review access permissions and revoke them when they’re no longer needed.

- Choose Reliable Remote Access Tools: Opt for reputable remote access solutions that prioritize security and compliance, such as AnyViewer.

Tools for Remote Access in Banking

There’s a plethora of tools available for remote access, but not all are created equal. Here are some popular options that are often recommended for finance and banking:

- VPNs: Virtual Private Networks create a secure connection over the internet, allowing users to access the bank’s internal network from anywhere safely.

- Remote Desktop Applications: Software like TeamViewer and AnyViewer allows users to control a computer remotely, making it easy to access files and applications without being physically present.

- Cloud Services: Platforms such as Google Drive or Microsoft OneDrive enable secure document sharing and collaboration, essential for remote teams.

Choosing the Right Remote Access Software

When it comes to selecting remote access software for finance and banking, it’s essential to consider a few key factors to ensure you get the most suitable solution for your needs.

Key Features to Look For

- Security Features: As previously mentioned, security is paramount. Look for software that offers strong encryption, two-factor authentication, and regular security updates.

- User-Friendly Interface: A clean, intuitive interface ensures that your team can jump right in without extensive training. After all, no one wants to spend hours figuring out how to connect!

- Compatibility and Integration: Ensure the software you choose integrates seamlessly with existing systems. Compatibility with your current infrastructure can save time and reduce the risk of technical issues.

User-Friendly Interface

Having a user-friendly interface is crucial for finance professionals who may not be tech-savvy. A simple layout can make the remote access experience smoother and more enjoyable. It also minimizes training time, allowing teams to focus on what truly matters—serving their clients.

Compatibility and Integration

The finance world relies on various software tools to operate effectively. Choosing remote access software that integrates well with your existing systems means fewer headaches and smoother operations. You want a solution that plays nicely with your existing applications, enhancing productivity rather than complicating it.

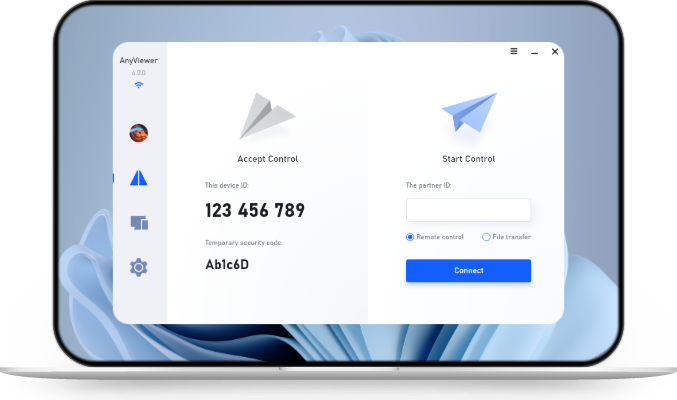

AnyViewer: Best Free Remote Access Software

AnyViewer stands out as the best remote access software for the finance and banking sector, offering an unparalleled combination of security, efficiency, and performance. Financial institutions and professionals require robust protection for sensitive transactions and data, and AnyViewer delivers just that with advanced encryption protocols, multi-layered security features, and two-factor authentication to ensure that only authorized users can gain access.

Its seamless integration across multiple platforms enables finance teams to work efficiently from any location, without compromising security. Whether you're remotely accessing a work computer to monitor accounts, accessing trading platforms, viewing sensitive financial reports, or managing client portfolios, AnyViewer's lightning-fast connection speeds and user-friendly interface make remote operations smooth and hassle-free.Whether on a desktop, tablet, or mobile device, users can access their work computer securely and effortlessly, all while complying with stringent regulatory standards.

Designed with the specific needs of the finance industry in mind, it ensures compliance with strict regulatory standards while offering exceptional performance. For organizations that prioritize security, reliability, and efficiency, AnyViewer is the obvious choice for remote access needs in a variety of industries.

Step 1. Download and install AnyViewer on both your local and remote devices. Go to the "Log in" section, select "Sign up," and complete the registration process by entering the required information.

Step 2. After logging in, your devices will automatically sync with your account.

Step 3. Ensure you're logged into both devices with the same credentials. Navigate to the "Device" tab, locate your remote device, and click on "One-click control" to enable unattended remote access.

- ★Tips: AnyViewer enhances your remote control experience with advanced features that make remote work more seamless and efficient. Upgrading to the Professional or Enterprise plan provides access to superior visuals and extra tools:

- Advanced Unattended Access: Effortlessly manage multiple devices while tracking every connection with a detailed history log.

- Privacy Mode: Safeguard your privacy by hiding the remote screen and disabling input on the remote device for added security.

- Faster File Transfers: Speed up data exchanges between devices with faster transfer speeds.

- 4:4:4 Color Accuracy: Experience accurate color reproduction through equal sampling of all color components for stunning visual quality.

- High Frame Rates: Enjoy smooth, real-time interactions with frame rates of up to 60 FPS, perfect for tasks like video editing.

- Ultra HD Streaming: Tackle high-resolution projects confidently with sharp, clear Ultra HD streaming.

- ...

To optimize image quality during remote access, follow these steps:

Step 1. Once your remote device is set up, use your keyboard and mouse to control it. During the session, click on the toolbar located at the top center of the screen, then go to Image > Image Quality > Ultra HD Mode to enable UHD on your home device.

Step 2. After that, select Image > Frame Rate > Up to 60 FPS to ensure smooth and high-definition visuals.

Step 3. Lastly, navigate to Image > Color Mode > True Color to get precise color representation with 4:4:4 chroma sampling. Now you can enjoy a premium remote access experience with AnyViewer!

Conclusion

In conclusion, remote access for finance and banking is essential for enhancing security and efficiency in today's digital landscape. As financial institutions embrace this technology, solutions like AnyViewer emerge as the top choice, offering robust security features and seamless usability. By prioritizing remote access for finance and banking services, professionals can work securely from any location, ensuring compliance with regulatory standards and improving overall productivity. Investing in reliable remote access solutions paves the way for a more flexible and efficient future in the finance industry.